Page 6 - Chap20 Inspection, Search & Seizure

P. 6

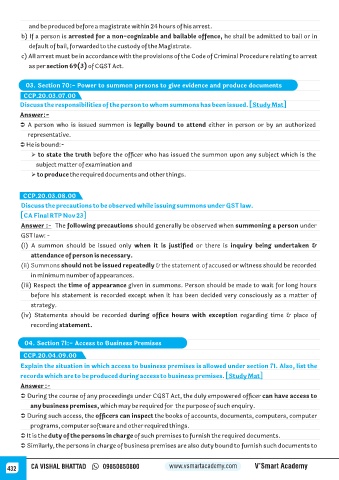

and be produced before a magistrate within 24 hours of his arrest.

b) If a person is arrested for a non-cognizable and bailable offence, he shall be admitted to bail or in

default of bail, forwarded to the custody of the Magistrate.

c) All arrest must be in accordance with the provisions of the Code of Criminal Procedure relating to arrest

as per section 69(3) of CGST Act.

03. Section 70:- Power to summon persons to give evidence and produce documents

CCP.20.03.07.00

Discuss the responsibilities of the person to whom summons has been issued. [Study Mat]

Answer:-

Ü A person who is issued summon is legally bound to attend either in person or by an authorized

representative.

Ü He is bound:-

Ø to state the truth before the officer who has issued the summon upon any subject which is the

subject matter of examination and

Ø to produce the required documents and other things.

CCP.20.03.08.00

Discuss the precautions to be observed while issuing summons under GST law.

[CA Final RTP Nov 23]

Answer :- The following precautions should generally be observed when summoning a person under

GST law: -

(i) A summon should be issued only when it is justified or there is inquiry being undertaken &

attendance of person is necessary.

(ii) Summons should not be issued repeatedly & the statement of accused or witness should be recorded

in minimum number of appearances.

(iii) Respect the time of appearance given in summons. Person should be made to wait for long hours

before his statement is recorded except when it has been decided very consciously as a matter of

strategy.

(iv) Statements should be recorded during office hours with exception regarding time & place of

recording statement.

04. Section 71:- Access to Business Premises

CCP.20.04.09.00

Explain the situation in which access to business premises is allowed under section 71. Also, list the

records which are to be produced during access to business premises. [Study Mat]

Answer :-

Ü During the course of any proceedings under CGST Act, the duly empowered officer can have access to

any business premises, which may be required for the purpose of such enquiry.

Ü During such access, the officers can inspect the books of accounts, documents, computers, computer

programs, computer software and other required things.

Ü It is the duty of the persons in charge of such premises to furnish the required documents.

Ü Similarly, the persons in charge of business premises are also duty bound to furnish such documents to

432 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy