Page 10 - Chap21 Offences & Penalties

P. 10

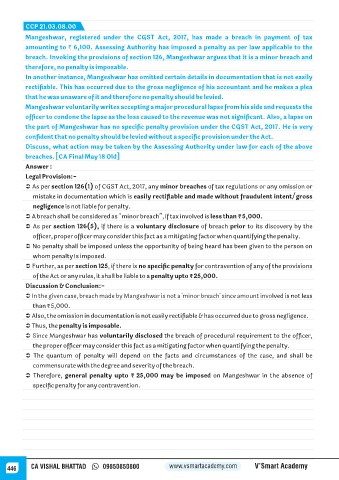

CCP 21.03.08.00

Mangeshwar, registered under the CGST Act, 2017, has made a breach in payment of tax

amounting to ` 6,100. Assessing Authority has imposed a penalty as per law applicable to the

breach. Invoking the provisions of section 126, Mangeshwar argues that it is a minor breach and

therefore, no penalty is imposable.

In another instance, Mangeshwar has omitted certain details in documentation that is not easily

rectifiable. This has occurred due to the gross negligence of his accountant and he makes a plea

that he was unaware of it and therefore no penalty should be levied.

Mangeshwar voluntarily writes accepting a major procedural lapse from his side and requests the

officer to condone the lapse as the loss caused to the revenue was not significant. Also, a lapse on

the part of Mangeshwar has no specific penalty provision under the CGST Act, 2017. He is very

confident that no penalty should be levied without a specific provision under the Act.

Discuss, what action may be taken by the Assessing Authority under law for each of the above

breaches. [CA Final May 18 Old]

Answer :

Legal Provision:-

Ü As per section 126(1) of CGST Act, 2017, any minor breaches of tax regulations or any omission or

mistake in documentation which is easily rectifiable and made without fraudulent intent/gross

negligence is not liable for penalty.

Ü A breach shall be considered as “minor breach”, if tax involved is less than ₹ 5,000.

Ü As per section 126(5), if there is a voluntary disclosure of breach prior to its discovery by the

officer, proper officer may consider this fact as a mitigating factor when quantifying the penalty.

Ü No penalty shall be imposed unless the opportunity of being heard has been given to the person on

whom penalty Is imposed.

Ü Further, as per section 125, if there is no specific penalty for contravention of any of the provisions

of the Act or any rules, it shall be liable to a penalty upto ₹ 25,000.

Discussion & Conclusion:-

Ü In the given case, breach made by Mangeshwar is not a 'minor breach' since amount involved is not less

than ₹ 5,000.

Ü Also, the omission in documentation is not easily rectifiable & has occurred due to gross negligence.

Ü Thus, the penalty is imposable.

Ü Since Mangeshwar has voluntarily disclosed the breach of procedural requirement to the officer,

the proper officer may consider this fact as a mitigating factor when quantifying the penalty.

Ü The quantum of penalty will depend on the facts and circumstances of the case, and shall be

commensurate with the degree and severity of the breach.

Ü Therefore, general penalty upto ₹ 25,000 may be imposed on Mangeshwar in the absence of

specific penalty for any contravention.

446 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy