Page 16 - Chap21 Offences & Penalties

P. 16

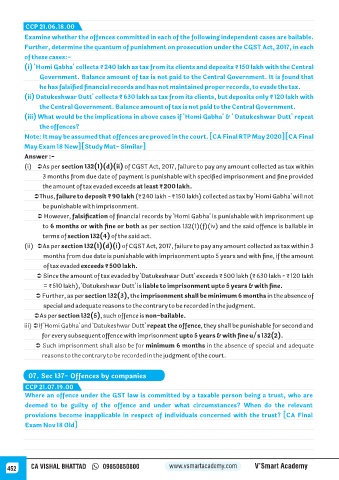

CCP 21.06.18.00

Examine whether the offences committed in each of the following independent cases are bailable.

Further, determine the quantum of punishment on prosecution under the CGST Act, 2017, in each

of these cases:-

(i) 'Homi Gabha' collects ₹ 240 lakh as tax from its clients and deposits ₹ 150 lakh with the Central

Government. Balance amount of tax is not paid to the Central Government. It is found that

he has falsified financial records and has not maintained proper records, to evade the tax.

(ii) Datukeshwar Dutt' collects ₹ 630 lakh as tax from its clients, but deposits only ₹ 120 lakh with

the Central Government. Balance amount of tax is not paid to the Central Government.

(iii) What would be the implications in above cases if 'Homi Gabha' & ' Datukeshwar Dutt' repeat

the offences?

Note: It may be assumed that offences are proved in the court. [CA Final RTP May 2020] [CA Final

May Exam 18 New] [Study Mat- Similar]

Answer :-

(i) ÜAs per section 132(1)(d)(ii) of CGST Act, 2017, failure to pay any amount collected as tax within

3 months from due date of payment is punishable with specified imprisonment and fine provided

the amount of tax evaded exceeds at least ₹ 200 lakh.

ÜThus, failure to deposit ₹ 90 lakh (₹ 240 lakh - ₹ 150 lakh) collected as tax by 'Homi Gabha' will not

be punishable with imprisonment.

Ü However, falsification of financial records by 'Homi Gabha' is punishable with imprisonment up

to 6 months or with fine or both as per section 132(1)(f)(iv) and the said offence is bailable in

terms of section 132(4) of the said act.

(ii) ÜAs per section 132(1)(d)(i) of CGST Act, 2017, failure to pay any amount collected as tax within 3

months from due date is punishable with imprisonment upto 5 years and with fine, if the amount

of tax evaded exceeds ₹ 500 lakh.

Ü Since the amount of tax evaded by 'Datukeshwar Dutt' exceeds ₹ 500 lakh (₹ 630 lakh - ₹ 120 lakh

= ₹ 510 lakh), 'Datukeshwar Dutt' is liable to imprisonment upto 5 years & with fine.

Ü Further, as per section 132(3), the imprisonment shall be minimum 6 months in the absence of

special and adequate reasons to the contrary to be recorded in the judgment.

ÜAs per section 132(5), such offence is non-bailable.

iii) ÜIf 'Homi Gabha' and 'Datukeshwar Dutt' repeat the offence, they shall be punishable for second and

for every subsequent offence with imprisonment upto 5 years & with fine u/s 132(2).

Ü Such imprisonment shall also be for minimum 6 months in the absence of special and adequate

reasons to the contrary to be recorded in the judgment of the court.

07. Sec 137- Offences by companies

CCP 21.07.19.00

Where an offence under the GST law is committed by a taxable person being a trust, who are

deemed to be guilty of the offence and under what circumstances? When do the relevant

provisions become inapplicable in respect of individuals concerned with the trust? [CA Final

Exam Nov 18 Old]

452 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy