Page 8 - Chap23Miscellaneous Provision

P. 8

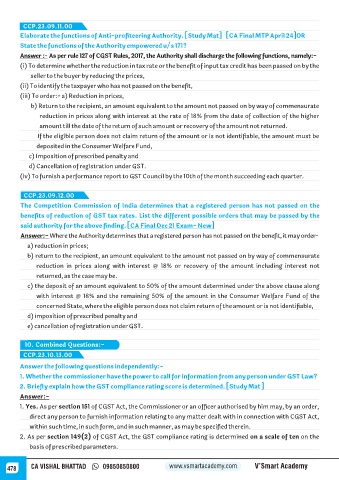

CCP.23.09.11.00

Elaborate the functions of Anti-profiteering Authority. [Study Mat] [CA Final MTP April 24]OR

State the functions of the Authority empowered u/s 171?

Answer :- As per rule 127 of CGST Rules, 2017, the Authority shall discharge the following functions, namely:-

(i) To determine whether the reduction in tax rate or the benefit of input tax credit has been passed on by the

seller to the buyer by reducing the prices,

(ii) To identify the taxpayer who has not passed on the benefit,

(iii) To order:- a) Reduction in prices,

b) Return to the recipient, an amount equivalent to the amount not passed on by way of commensurate

reduction in prices along with interest at the rate of 18% from the date of collection of the higher

amount till the date of the return of such amount or recovery of the amount not returned.

If the eligible person does not claim return of the amount or is not identifiable, the amount must be

deposited in the Consumer Welfare Fund,

c) Imposition of prescribed penalty and

d) Cancellation of registration under GST.

(iv) To furnish a performance report to GST Council by the 10th of the month succeeding each quarter.

CCP.23.09.12.00

The Competition Commission of India determines that a registered person has not passed on the

benefits of reduction of GST tax rates. List the different possible orders that may be passed by the

said authority for the above finding. [CA Final Dec 21 Exam- New]

Answer:- Where the Authority determines that a registered person has not passed on the benefit, it may order-

a) reduction in prices;

b) return to the recipient, an amount equivalent to the amount not passed on by way of commensurate

reduction in prices along with interest @ 18% or recovery of the amount including interest not

returned, as the case may be.

c) the deposit of an amount equivalent to 50% of the amount determined under the above clause along

with interest @ 18% and the remaining 50% of the amount in the Consumer Welfare Fund of the

concerned State, where the eligible person does not claim return of the amount or is not identifiable,

d) imposition of prescribed penalty and

e) cancellation of registration under GST.

10. Combined Questions:-

CCP.23.10.13.00

Answer the following questions independently:-

1. Whether the commissioner have the power to call for information from any person under GST Law?

2. Briefly explain how the GST compliance rating score is determined. [Study Mat ]

Answer:-

1. Yes. As per section 151 of CGST Act, the Commissioner or an officer authorised by him may, by an order,

direct any person to furnish information relating to any matter dealt with in connection with CGST Act,

within such time, in such form, and in such manner, as may be specified therein.

2. As per section 149(2) of CGST Act, the GST compliance rating is determined on a scale of ten on the

basis of prescribed parameters.

478 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy