Page 284 - CA Inter Audit PARAM

P. 284

CA Ravi Taori

The auditor has to see that the expenditure incurred conforms to the relevant provisions of

the statutory enactment and is in accordance with the financial rules and regulations framed

by the competent authority.

Audit of Sanctions:

The auditor has to ensure that each item of expenditure is covered by a sanction, either

general or special, accorded by the competent authority, authorizing such expenditure.

Audit against Provision of Funds: Audit against provision of funds is aimed at ascertaining

whether the monies shown in the accounts as having been disbursed, were legally available

for and applicable to the service or purpose to which they have been applied or charged.

Propriety Audit:

It is required to be seen that the expenditure is incurred with due regard to broad and general

principles of financial propriety. The auditor aims to bring out cases of improper, avoidable,

or in fructuous expenditure even though the expenditure has been incurred in conformity with

the existing rules and regulations. Audit aims to secure a reasonably high standard of public

financial morality by looking into the wisdom, faithfulness and economy of transactions.

Performance Audit:

This involves that the various programmes, schemes and projects where large financial

expenditure has been incurred are being run economically and are yielding results expected

of them. Efficiency-cum performance audit, wherever used, is an objective examination of the

financial and operational performance of an organization, programme, authority or function

and is oriented towards identifying opportunities for greater economy, and effectiveness.

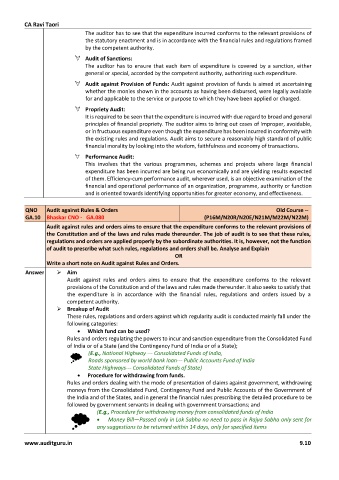

QNO Audit against Rules & Orders Old Course --

GA.10 Bhaskar CNO - GA.080 (P16M/N20R/N20E/N21M/M22M/N22M)

Audit against rules and orders aims to ensure that the expenditure conforms to the relevant provisions of

the Constitution and of the laws and rules made thereunder. The job of audit is to see that these rules,

regulations and orders are applied properly by the subordinate authorities. It is, however, not the function

of audit to prescribe what such rules, regulations and orders shall be. Analyse and Explain

OR

Write a short note on Audit against Rules and Orders.

Answer ➢ Aim

Audit against rules and orders aims to ensure that the expenditure conforms to the relevant

provisions of the Constitution and of the laws and rules made thereunder. It also seeks to satisfy that

the expenditure is in accordance with the financial rules, regulations and orders issued by a

competent authority.

➢ Breakup of Audit

These rules, regulations and orders against which regularity audit is conducted mainly fall under the

following categories:

• Which fund can be used?

Rules and orders regulating the powers to incur and sanction expenditure from the Consolidated Fund

of India or of a State (and the Contingency Fund of India or of a State);

(E.g., National Highway --- Consolidated Funds of India,

Roads sponsored by world bank loan--- Public Accounts Fund of India

State Highways--- Consolidated Funds of State)

• Procedure for withdrawing from funds.

Rules and orders dealing with the mode of presentation of claims against government, withdrawing

moneys from the Consolidated Fund, Contingency Fund and Public Accounts of the Government of

the India and of the States, and in general the financial rules prescribing the detailed procedure to be

followed by government servants in dealing with government transactions; and

(E.g., Procedure for withdrawing money from consolidated funds of India

• Money Bill—Passed only in Lok Sabha no need to pass in Rajya Sabha only sent for

any suggestions to be returned within 14 days, only for specified items

www.auditguru.in 9.10