Page 303 - CA Inter Audit PARAM

P. 303

CA Ravi Taori

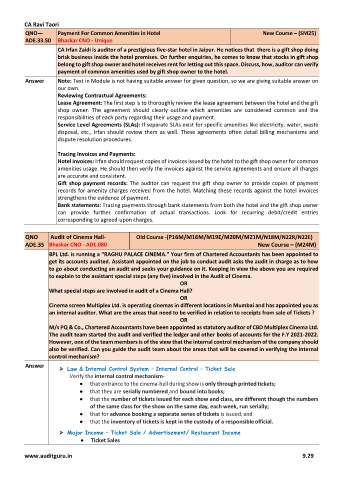

QNO— Payment For Common Amenities in Hotel New Course – (SM25)

ADE.33.50 Bhaskar CNO - Unique

CA Irfan Zaidi is auditor of a prestigious five-star hotel in Jaipur. He notices that there is a gift shop doing

brisk business inside the hotel premises. On further enquiries, he comes to know that stocks in gift shop

belong to gift shop owner and hotel receives rent for letting out this space. Discuss, how, auditor can verify

payment of common amenities used by gift shop owner to the hotel.

Answer Note: Text in Module is not having suitable answer for given question, so we are giving suitable answer on

our own.

Reviewing Contractual Agreements:

Lease Agreement: The first step is to thoroughly review the lease agreement between the hotel and the gift

shop owner. The agreement should clearly outline which amenities are considered common and the

responsibilities of each party regarding their usage and payment.

Service Level Agreements (SLAs): If separate SLAs exist for specific amenities like electricity, water, waste

disposal, etc., Irfan should review them as well. These agreements often detail billing mechanisms and

dispute resolution procedures.

Tracing Invoices and Payments:

Hotel invoices: Irfan should request copies of invoices issued by the hotel to the gift shop owner for common

amenities usage. He should then verify the invoices against the service agreements and ensure all charges

are accurate and consistent.

Gift shop payment records: The auditor can request the gift shop owner to provide copies of payment

records for amenity charges received from the hotel. Matching these records against the hotel invoices

strengthens the evidence of payment.

Bank statements: Tracing payments through bank statements from both the hotel and the gift shop owner

can provide further confirmation of actual transactions. Look for recurring debit/credit entries

corresponding to agreed-upon charges.

QNO Audit of Cinema Hall- Old Course -(P16M/M16M/M19E/M20M/M21M/N18M/N22R/N22E)

ADE.35 Bhaskar CNO - ADE.080 New Course – (M24M)

BPL Ltd. is running a “RAGHU PALACE CINEMA.” Your firm of Chartered Accountants has been appointed to

get its accounts audited. Assistant appointed on the job to conduct audit asks the audit in charge as to how

to go about conducting an audit and seeks your guidance on it. Keeping in view the above you are required

to explain to the assistant special steps (any five) involved in the Audit of Cinema.

OR

What special steps are involved in audit of a Cinema Hall?

OR

Cinema screen Multiplex Ltd. is operating cinemas in different locations in Mumbai and has appointed you as

an internal auditor. What are the areas that need to be verified in relation to receipts from sale of Tickets ?

OR

M/s PQ & Co., Chartered Accountants have been appointed as statutory auditor of CBD Multiplex Cinema Ltd.

The audit team started the audit and verified the ledger and other books of accounts for the F.Y 2021-2022.

However, one of the team members is of the view that the internal control mechanism of the company should

also be verified. Can you guide the audit team about the areas that will be covered in verifying the internal

control mechanism?

Answer ➢ Law & Internal Control System – Internal Control – Ticket Sale

Verify the internal control mechanism-

• that entrance to the cinema-hall during show is only through printed tickets;

• that they are serially numbered and bound into books;

• that the number of tickets issued for each show and class, are different though the numbers

of the same class for the show on the same day, each week, run serially;

• that for advance booking a separate series of tickets is issued; and

• that the inventory of tickets is kept in the custody of a responsible official.

➢ Major Income – Ticket Sale / Advertisement/ Restaurant Income

• Ticket Sales

www.auditguru.in 9.29