Page 324 - CA Inter Audit PARAM

P. 324

CA Ravi Taori

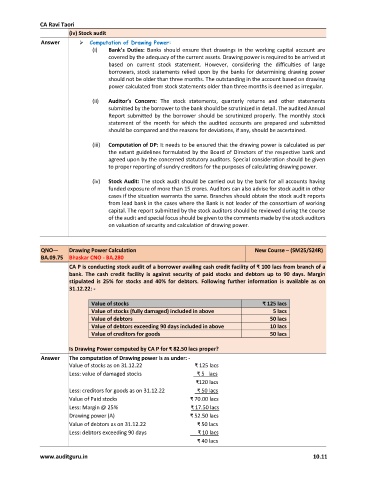

(iv) Stock audit

Answer Computation of Drawing Power:

(i) Bank’s Duties: Banks should ensure that drawings in the working capital account are

covered by the adequacy of the current assets. Drawing power is required to be arrived at

based on current stock statement. However, considering the difficulties of large

borrowers, stock statements relied upon by the banks for determining drawing power

should not be older than three months. The outstanding in the account based on drawing

power calculated from stock statements older than three months is deemed as irregular.

(ii) Auditor’s Concern: The stock statements, quarterly returns and other statements

submitted by the borrower to the bank should be scrutinized in detail. The audited Annual

Report submitted by the borrower should be scrutinized properly. The monthly stock

statement of the month for which the audited accounts are prepared and submitted

should be compared and the reasons for deviations, if any, should be ascertained.

(iii) Computation of DP: It needs to be ensured that the drawing power is calculated as per

the extant guidelines formulated by the Board of Directors of the respective bank and

agreed upon by the concerned statutory auditors. Special consideration should be given

to proper reporting of sundry creditors for the purposes of calculating drawing power.

(iv) Stock Audit: The stock audit should be carried out by the bank for all accounts having

funded exposure of more than 15 crores. Auditors can also advise for stock audit in other

cases if the situation warrants the same. Branches should obtain the stock audit reports

from lead bank in the cases where the Bank is not leader of the consortium of working

capital. The report submitted by the stock auditors should be reviewed during the course

of the audit and special focus should be given to the comments made by the stock auditors

on valuation of security and calculation of drawing power.

QNO— Drawing Power Calculation New Course – (SM25/S24R)

BA.09.75 Bhaskar CNO - BA.280

CA P is conducting stock audit of a borrower availing cash credit facility of ₹ 100 lacs from branch of a

bank. The cash credit facility is against security of paid stocks and debtors up to 90 days. Margin

stipulated is 25% for stocks and 40% for debtors. Following further information is available as on

31.12.22: -

Value of stocks ₹ 125 lacs

Value of stocks (fully damaged) included in above 5 lacs

Value of debtors 50 lacs

Value of debtors exceeding 90 days included in above 10 lacs

Value of creditors for goods 50 lacs

Is Drawing Power computed by CA P for ₹ 82.50 lacs proper?

Answer The computation of Drawing power is as under: -

Value of stocks as on 31.12.22 ₹ 125 lacs

Less: value of damaged stocks ₹ 5 lacs

₹120 lacs

Less: creditors for goods as on 31.12.22 ₹ 50 lacs

Value of Paid stocks ₹ 70.00 lacs

Less: Margin @ 25% ₹ 17.50 lacs

Drawing power (A) ₹ 52.50 lacs

Value of debtors as on 31.12.22 ₹ 50 lacs

Less: debtors exceeding 90 days ₹ 10 lacs

₹ 40 lacs

www.auditguru.in 10.11