Page 325 - CA Inter Audit PARAM

P. 325

CA Ravi Taori

Less: Margin @ 40% ₹ 16 lacs

Drawing Power (B) ₹ 24 lacs

Drawing Power (A+B) ₹ 76.50 lacs

The drawing power calculated by CA P is not proper. Drawing Power comes to ₹ 76.50 lacs.

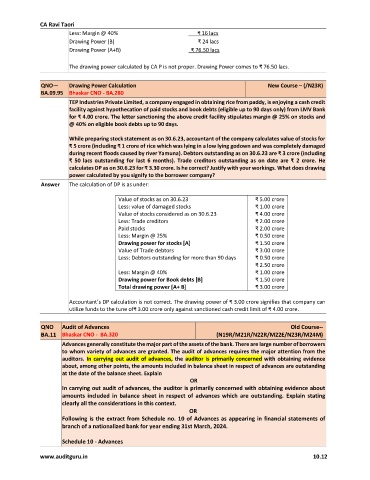

QNO— Drawing Power Calculation New Course – (/N23R)

BA.09.95 Bhaskar CNO - BA.280

TEP Industries Private Limited, a company engaged in obtaining rice from paddy, is enjoying a cash credit

facility against hypothecation of paid stocks and book debts (eligible up to 90 days only) from LMV Bank

for ₹ 4.00 crore. The letter sanctioning the above credit facility stipulates margin @ 25% on stocks and

@ 40% on eligible book debts up to 90 days.

While preparing stock statement as on 30.6.23, accountant of the company calculates value of stocks for

₹ 5 crore (including ₹ 1 crore of rice which was lying in a low lying godown and was completely damaged

during recent floods caused by river Yamuna). Debtors outstanding as on 30.6.23 are ₹ 3 crore (including

₹ 50 lacs outstanding for last 6 months). Trade creditors outstanding as on date are ₹ 2 crore. He

calculates DP as on 30.6.23 for ₹ 3.30 crore. Is he correct? Justify with your workings. What does drawing

power calculated by you signify to the borrower company?

Answer The calculation of DP is as under:

Value of stocks as on 30.6.23 ₹ 5.00 crore

Less: value of damaged stocks ₹ 1.00 crore

Value of stocks considered as on 30.6.23 ₹ 4.00 crore

Less: Trade creditors ₹ 2.00 crore

Paid stocks ₹ 2.00 crore

Less: Margin @ 25% ₹ 0.50 crore

Drawing power for stocks [A] ₹ 1.50 crore

Value of Trade debtors ₹ 3.00 crore

Less: Debtors outstanding for more than 90 days ₹ 0.50 crore

₹ 2.50 crore

Less: Margin @ 40% ₹ 1.00 crore

Drawing power for Book debts [B] ₹ 1.50 crore

Total drawing power [A+ B] ₹ 3.00 crore

Accountant’s DP calculation is not correct. The drawing power of ₹ 3.00 crore signifies that company can

utilize funds to the tune of₹ 3.00 crore only against sanctioned cash credit limit of ₹ 4.00 crore.

QNO Audit of Advances Old Course--

BA.11 Bhaskar CNO - BA.320 (N19R/M21R/N22R/M22E/N23R/M24M)

Advances generally constitute the major part of the assets of the bank. There are large number of borrowers

to whom variety of advances are granted. The audit of advances requires the major attention from the

auditors. In carrying out audit of advances, the auditor is primarily concerned with obtaining evidence

about, among other points, the amounts included in balance sheet in respect of advances are outstanding

at the date of the balance sheet. Explain

OR

In carrying out audit of advances, the auditor is primarily concerned with obtaining evidence about

amounts included in balance sheet in respect of advances which are outstanding. Explain stating

clearly all the considerations in this context.

OR

Following is the extract from Schedule no. 10 of Advances as appearing in financial statements of

branch of a nationalized bank for year ending 31st March, 2024.

Schedule 10 - Advances

www.auditguru.in 10.12