Page 195 - CA Inter Audit PARAM

P. 195

CA Ravi Taori

• with the notice of demand

➢ Interest

• The interest allowed on advance payments of income-tax should be included as income and

penal interest charged for non-payment should be debited to the interest account.

➢ Electronic Payment

• Nowadays, electronic payment of taxes is also in trend. Electronic payment of taxes means

payment of taxes by way of internet banking facility or credit or debit cards.

• The assesses can make electronic payment of taxes also from the account of any other

person. However, the challan for making such payment must clearly indicate the Permanent

Account Number (PAN) of the assesses on whose behalf the payment is made.

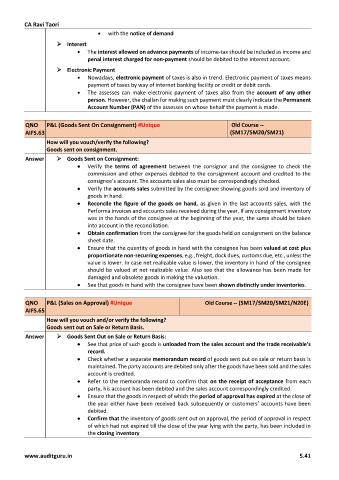

QNO P&L (Goods Sent On Consignment) #Unique

Old Course --

AIFS.63 (SM17/SM20/SM21)

How will you vouch/verify the following?

Goods sent on consignment.

Answer ➢ Goods Sent on Consignment:

• Verify the terms of agreement between the consignor and the consignee to check the

commission and other expenses debited to the consignment account and credited to the

consignee’s account. The accounts sales also must be correspondingly checked.

• Verify the accounts sales submitted by the consignee showing goods sold and inventory of

goods in hand.

• Reconcile the figure of the goods on hand, as given in the last accounts sales, with the

Performa invoices and accounts sales received during the year. If any consignment inventory

was in the hands of the consignee at the beginning of the year, the same should be taken

into account in the reconciliation.

• Obtain confirmation from the consignee for the goods held on consignment on the balance

sheet date.

• Ensure that the quantity of goods in hand with the consignee has been valued at cost plus

proportionate non-recurring expenses, e.g., freight, dock dues, customs due, etc., unless the

value is lower. In case net realizable value is lower, the inventory in hand of the consignee

should be valued at net realizable value. Also see that the allowance has been made for

damaged and obsolete goods in making the valuation.

• See that goods in hand with the consignee have been shown distinctly under inventories.

QNO P&L (Sales on Approval) #Unique Old Course -- (SM17/SM20/SM21/N20E)

AIFS.65

How will you vouch and/or verify the following?

Goods sent out on Sale or Return Basis.

Answer ➢ Goods Sent Out on Sale or Return Basis:

• See that price of such goods is unloaded from the sales account and the trade receivable’s

record.

• Check whether a separate memorandum record of goods sent out on sale or return basis is

maintained. The party accounts are debited only after the goods have been sold and the sales

account is credited.

• Refer to the memoranda record to confirm that on the receipt of acceptance from each

party, his account has been debited and the sales account correspondingly credited.

• Ensure that the goods in respect of which the period of approval has expired at the close of

the year either have been received back subsequently or customers’ accounts have been

debited.

• Confirm that the inventory of goods sent out on approval, the period of approval in respect

of which had not expired till the close of the year lying with the party, has been included in

the closing inventory

www.auditguru.in 5.41