Page 196 - CA Inter Audit PARAM

P. 196

CA Ravi Taori

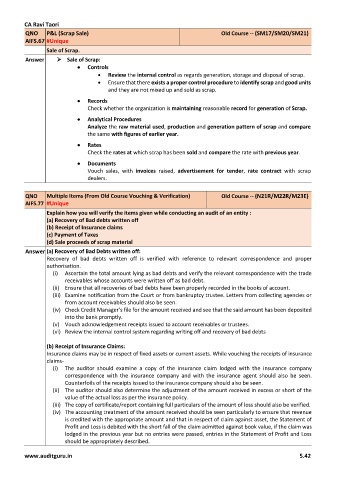

QNO P&L (Scrap Sale) Old Course -- (SM17/SM20/SM21)

AIFS.67 #Unique

Sale of Scrap.

Answer ➢ Sale of Scrap:

• Controls

• Review the internal control as regards generation, storage and disposal of scrap.

• Ensure that there exists a proper control procedure to identify scrap and good units

and they are not mixed up and sold as scrap.

• Records

Check whether the organization is maintaining reasonable record for generation of Scrap.

• Analytical Procedures

Analyze the raw material used, production and generation pattern of scrap and compare

the same with figures of earlier year.

• Rates

Check the rates at which scrap has been sold and compare the rate with previous year.

• Documents

Vouch sales, with invoices raised, advertisement for tender, rate contract with scrap

dealers.

QNO Multiple Items (From Old Course Vouching & Verification) Old Course -- (N21R/M22R/M23E)

AIFS.77 #Unique

Explain how you will verify the items given while conducting an audit of an entity :

(a) Recovery of Bad debts written off

(b) Receipt of Insurance claims

(c) Payment of Taxes

(d) Sale proceeds of scrap material

Answer (a) Recovery of Bad Debts written off:

Recovery of bad debts written off is verified with reference to relevant correspondence and proper

authorisation.

(i) Ascertain the total amount lying as bad debts and verify the relevant correspondence with the trade

receivables whose accounts were written off as bad debt.

(ii) Ensure that all recoveries of bad debts have been properly recorded in the books of account.

(iii) Examine notification from the Court or from bankruptcy trustee. Letters from collecting agencies or

from account receivables should also be seen.

(iv) Check Credit Manager’s file for the amount received and see that the said amount has been deposited

into the bank promptly.

(v) Vouch acknowledgement receipts issued to account receivables or trustees.

(vi) Review the internal control system regarding writing off and recovery of bad debts

(b) Receipt of Insurance Claims:

Insurance claims may be in respect of fixed assets or current assets. While vouching the receipts of insurance

claims-

(i) The auditor should examine a copy of the insurance claim lodged with the insurance company

correspondence with the insurance company and with the insurance agent should also be seen.

Counterfoils of the receipts issued to the insurance company should also be seen.

(ii) The auditor should also determine the adjustment of the amount received in excess or short of the

value of the actual loss as per the insurance policy.

(iii) The copy of certificate/report containing full particulars of the amount of loss should also be verified.

(iv) The accounting treatment of the amount received should be seen particularly to ensure that revenue

is credited with the appropriate amount and that in respect of claim against asset, the Statement of

Profit and Loss is debited with the short fall of the claim admitted against book value, if the claim was

lodged in the previous year but no entries were passed, entries in the Statement of Profit and Loss

should be appropriately described.

www.auditguru.in 5.42