Page 197 - CA Inter Audit PARAM

P. 197

CA Ravi Taori

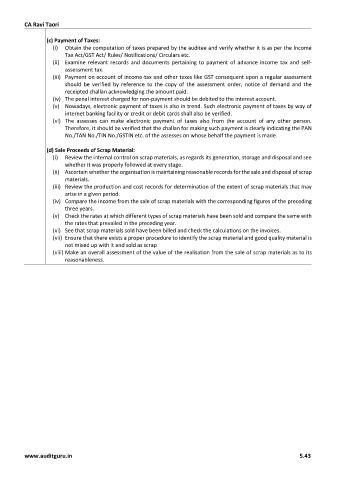

(c) Payment of Taxes:

(i) Obtain the computation of taxes prepared by the auditee and verify whether it is as per the Income

Tax Act/GST Act/ Rules/ Notifications/ Circulars etc.

(ii) Examine relevant records and documents pertaining to payment of advance income tax and self-

assessment tax.

(iii) Payment on account of income-tax and other taxes like GST consequent upon a regular assessment

should be verified by reference to the copy of the assessment order, notice of demand and the

receipted challan acknowledging the amount paid.

(iv) The penal interest charged for non-payment should be debited to the interest account.

(v) Nowadays, electronic payment of taxes is also in trend. Such electronic payment of taxes by way of

internet banking facility or credit or debit cards shall also be verified.

(vi) The assesses can make electronic payment of taxes also from the account of any other person.

Therefore, it should be verified that the challan for making such payment is clearly indicating the PAN

No./TAN No./TIN No./GSTIN etc. of the assesses on whose behalf the payment is made.

(d) Sale Proceeds of Scrap Material:

(i) Review the internal control on scrap materials, as regards its generation, storage and disposal and see

whether it was properly followed at every stage.

(ii) Ascertain whether the organisation is maintaining reasonable records for the sale and disposal of scrap

materials.

(iii) Review the production and cost records for determination of the extent of scrap materials that may

arise in a given period.

(iv) Compare the income from the sale of scrap materials with the corresponding figures of the preceding

three years.

(v) Check the rates at which different types of scrap materials have been sold and compare the same with

the rates that prevailed in the preceding year.

(vi) See that scrap materials sold have been billed and check the calculations on the invoices.

(vii) Ensure that there exists a proper procedure to identify the scrap material and good quality material is

not mixed up with it and sold as scrap

(viii) Make an overall assessment of the value of the realisation from the sale of scrap materials as to its

reasonableness.

www.auditguru.in 5.43