Page 4 - Chap19 Liability to pay certain cases

P. 4

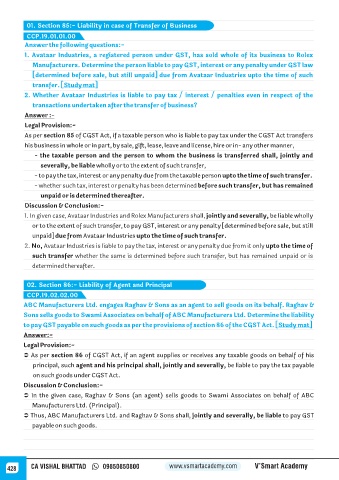

01. Section 85:- Liability in case of Transfer of Business

CCP.19.01.01.00

Answer the following questions:-

1. Avataar Industries, a registered person under GST, has sold whole of its business to Rolex

Manufacturers. Determine the person liable to pay GST, interest or any penalty under GST law

[determined before sale, but still unpaid] due from Avataar Industries upto the time of such

transfer. [Study mat]

2. Whether Avataar Industries is liable to pay tax / interest / penalties even in respect of the

transactions undertaken after the transfer of business?

Answer :-

Legal Provision:-

As per section 85 of CGST Act, if a taxable person who is liable to pay tax under the CGST Act transfers

his business in whole or in part, by sale, gift, lease, leave and license, hire or in- any other manner,

- the taxable person and the person to whom the business is transferred shall, jointly and

severally, be liable wholly or to the extent of such transfer,

- to pay the tax, interest or any penalty due from the taxable person upto the time of such transfer.

- whether such tax, interest or penalty has been determined before such transfer, but has remained

unpaid or is determined thereafter.

Discussion & Conclusion:-

1. In given case, Avataar Industries and Rolex Manufacturers shall, jointly and severally, be liable wholly

or to the extent of such transfer, to pay GST, interest or any penalty [determined before sale, but still

unpaid] due from Avataar Industries upto the time of such transfer.

2. No, Avataar Industries is liable to pay the tax, interest or any penalty due from it only upto the time of

such transfer whether the same is determined before such transfer, but has remained unpaid or is

determined thereafter.

02. Section 86:- Liability of Agent and Principal

CCP.19.02.02.00

ABC Manufacturers Ltd. engages Raghav & Sons as an agent to sell goods on its behalf. Raghav &

Sons sells goods to Swami Associates on behalf of ABC Manufacturers Ltd. Determine the liability

to pay GST payable on such goods as per the provisions of section 86 of the CGST Act. [Study mat]

Answer:-

Legal Provision:-

Ü As per section 86 of CGST Act, if an agent supplies or receives any taxable goods on behalf of his

principal, such agent and his principal shall, jointly and severally, be liable to pay the tax payable

on such goods under CGST Act.

Discussion & Conclusion:-

Ü In the given case, Raghav & Sons (an agent) sells goods to Swami Associates on behalf of ABC

Manufacturers Ltd. (Principal).

Ü Thus, ABC Manufacturers Ltd. and Raghav & Sons shall, jointly and severally, be liable to pay GST

payable on such goods.

428 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy