Page 5 - Chap19 Liability to pay certain cases

P. 5

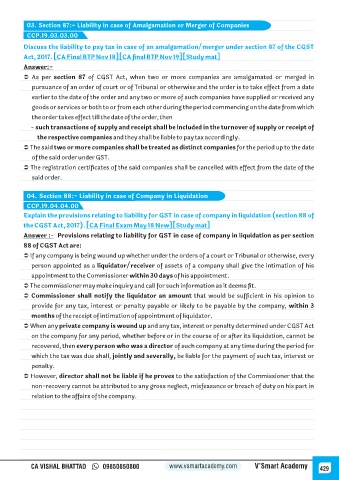

03. Section 87:- Liability in case of Amalgamation or Merger of Companies

CCP.19.03.03.00

Discuss the liability to pay tax in case of an amalgamation/merger under section 87 of the CGST

Act, 2017. [CA Final RTP Nov 18] [CA final RTP Nov 19] [Study mat]

Answer:-

Ü As per section 87 of CGST Act, when two or more companies are amalgamated or merged in

pursuance of an order of court or of Tribunal or otherwise and the order is to take effect from a date

earlier to the date of the order and any two or more of such companies have supplied or received any

goods or services or both to or from each other during the period commencing on the date from which

the order takes effect till the date of the order, then

- such transactions of supply and receipt shall be included in the turnover of supply or receipt of

the respective companies and they shall be liable to pay tax accordingly.

Ü The said two or more companies shall be treated as distinct companies for the period up to the date

of the said order under GST.

Ü The registration certificates of the said companies shall be cancelled with effect from the date of the

said order.

04. Section 88:- Liability in case of Company in Liquidation

CCP.19.04.04.00

Explain the provisions relating to liability for GST in case of company in liquidation (section 88 of

the CGST Act, 2017). [CA Final Exam May 18 New] [Study mat]

Answer :- Provisions relating to liability for GST in case of company in liquidation as per section

88 of CGST Act are:

Ü If any company is being wound up whether under the orders of a court or Tribunal or otherwise, every

person appointed as a liquidator/receiver of assets of a company shall give the intimation of his

appointment to the Commissioner within 30 days of his appointment.

Ü The commissioner may make inquiry and call for such information as it deems fit.

Ü Commissioner shall notify the liquidator an amount that would be sufficient in his opinion to

provide for any tax, interest or penalty payable or likely to be payable by the company, within 3

months of the receipt of intimation of appointment of liquidator.

Ü When any private company is wound up and any tax, interest or penalty determined under CGST Act

on the company for any period, whether before or in the course of or after its liquidation, cannot be

recovered, then every person who was a director of such company at any time during the period for

which the tax was due shall, jointly and severally, be liable for the payment of such tax, interest or

penalty.

Ü However, director shall not be liable if he proves to the satisfaction of the Commissioner that the

non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part in

relation to the affairs of the company.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 429