Page 7 - Chap19 Liability to pay certain cases

P. 7

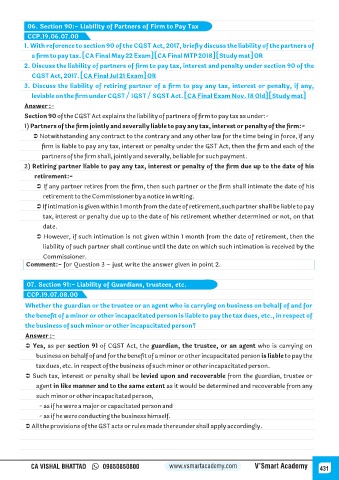

06. Section 90:- Liability of Partners of Firm to Pay Tax

CCP.19.06.07.00

1. With reference to section 90 of the CGST Act, 2017, briefly discuss the liability of the partners of

a firm to pay tax. [CA Final May 22 Exam] [CA Final MTP 2018] [Study mat] OR

2. Discuss the liability of partners of firm to pay tax, interest and penalty under section 90 of the

CGST Act, 2017. [CA Final Jul 21 Exam] OR

3. Discuss the liability of retiring partner of a firm to pay any tax, interest or penalty, if any,

leviable on the firm under CGST / IGST / SGST Act. [CA Final Exam Nov. 18 Old] [Study mat]

Answer :-

Section 90 of the CGST Act explains the liability of partners of firm to pay tax as under:-

1) Partners of the firm jointly and severally liable to pay any tax, interest or penalty of the firm:-

Ü Notwithstanding any contract to the contrary and any other law for the time being in force, if any

firm is liable to pay any tax, interest or penalty under the GST Act, then the firm and each of the

partners of the firm shall, jointly and severally, be liable for such payment.

2) Retiring partner liable to pay any tax, interest or penalty of the firm due up to the date of his

retirement:-

Ü If any partner retires from the firm, then such partner or the firm shall intimate the date of his

retirement to the Commissioner by a notice in writing.

Ü If intimation is given within 1 month from the date of retirement,such partner shall be liable to pay

tax, interest or penalty due up to the date of his retirement whether determined or not, on that

date.

Ü However, if such intimation is not given within 1 month from the date of retirement, then the

liability of such partner shall continue until the date on which such intimation is received by the

Commissioner.

Comment:- for Question 3 – just write the answer given in point 2.

07. Section 91:- Liability of Guardians, trustees, etc.

CCP.19.07.08.00

Whether the guardian or the trustee or an agent who is carrying on business on behalf of and for

the benefit of a minor or other incapacitated person is liable to pay the tax dues, etc., in respect of

the business of such minor or other incapacitated person?

Answer :-

Ü Yes, as per section 91 of CGST Act, the guardian, the trustee, or an agent who is carrying on

business on behalf of and for the benefit of a minor or other incapacitated person is liable to pay the

tax dues, etc. in respect of the business of such minor or other incapacitated person.

Ü Such tax, interest or penalty shall be levied upon and recoverable from the guardian, trustee or

agent in like manner and to the same extent as it would be determined and recoverable from any

such minor or other incapacitated person,

- as if he were a major or capacitated person and

- as if he were conducting the business himself.

Ü All the provisions of the GST acts or rules made thereunder shall apply accordingly.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 431