Page 6 - Chap19 Liability to pay certain cases

P. 6

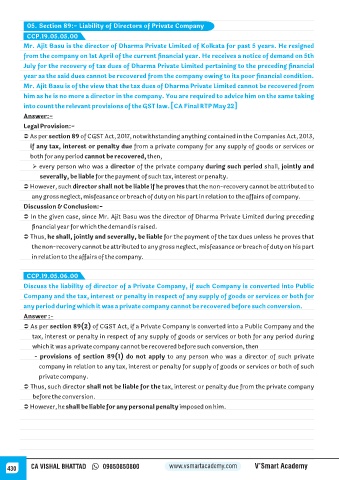

05. Section 89:- Liability of Directors of Private Company

CCP.19.05.05.00

Mr. Ajit Basu is the director of Dharma Private Limited of Kolkata for past 5 years. He resigned

from the company on 1st April of the current financial year. He receives a notice of demand on 5th

July for the recovery of tax dues of Dharma Private Limited pertaining to the preceding financial

year as the said dues cannot be recovered from the company owing to its poor financial condition.

Mr. Ajit Basu is of the view that the tax dues of Dharma Private Limited cannot be recovered from

him as he is no more a director in the company. You are required to advice him on the same taking

into count the relevant provisions of the GST law. [CA Final RTP May 22]

Answer:-

Legal Provision:-

Ü As per section 89 of CGST Act, 2017, notwithstanding anything contained in the Companies Act, 2013,

if any tax, interest or penalty due from a private company for any supply of goods or services or

both for any period cannot be recovered, then,

Ø every person who was a director of the private company during such period shall, jointly and

severally, be liable for the payment of such tax, interest or penalty.

Ü However, such director shall not be liable if he proves that the non-recovery cannot be attributed to

any gross neglect, misfeasance or breach of duty on his part in relation to the affairs of company.

Discussion & Conclusion:-

Ü In the given case, since Mr. Ajit Basu was the director of Dharma Private Limited during preceding

financial year for which the demand is raised.

Ü Thus, he shall, jointly and severally, be liable for the payment of the tax dues unless he proves that

the non-recovery cannot be attributed to any gross neglect, misfeasance or breach of duty on his part

in relation to the affairs of the company.

CCP.19.05.06.00

Discuss the liability of director of a Private Company, if such Company is converted into Public

Company and the tax, interest or penalty in respect of any supply of goods or services or both for

any period during which it was a private company cannot be recovered before such conversion.

Answer :-

Ü As per section 89(2) of CGST Act, if a Private Company is converted into a Public Company and the

tax, interest or penalty in respect of any supply of goods or services or both for any period during

which it was a private company cannot be recovered before such conversion, then

- provisions of section 89(1) do not apply to any person who was a director of such private

company in relation to any tax, interest or penalty for supply of goods or services or both of such

private company.

Ü Thus, such director shall not be liable for the tax, interest or penalty due from the private company

before the conversion.

Ü However, he shall be liable for any personal penalty imposed on him.

430 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy