Page 13 - Chap22 Appeals & Revision

P. 13

b) where the appellant was prevented by sufficient cause from producing the evidence which he was

called upon to produce by adjudicating authority or AA; or

c) where the appellant was prevented by sufficient cause from producing before the adjudicating

authority or AA any evidence which is relevant to any ground of appeal; or

d) where the adjudicating authority or AA has made the order appealed against without giving

sufficient opportunity to the appellant to adduce evidence relevant to any ground of appeal.

(3) No additional evidence shall be admitted unless the AA or the Appellate Tribunal records in writing the

reasons for its admission.

(4) AA or Appellate Tribunal shall not take any additional evidence unless the adjudicating authority or

an officer authorised by the said authority has been allowed a reasonable opportunity -

a) to examine evidence or document or to cross-examine any witness produced by appellant, or

b) to produce any evidence or witness in rebuttal of additional evidence produced by appellant.

(5) The rule shall not affect the power of the AA or Appellate Tribunal to direct the production of any

document, or the examination of any witness, to enable it to dispose of the appeal.

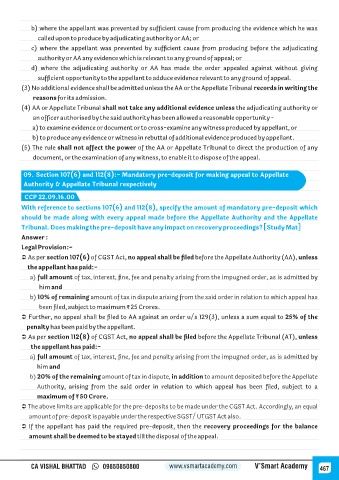

09. Section 107(6) and 112(8):- Mandatory pre-deposit for making appeal to Appellate

Authority & Appellate Tribunal respectively

CCP 22.09.16.00

With reference to sections 107(6) and 112(8), specify the amount of mandatory pre-deposit which

should be made along with every appeal made before the Appellate Authority and the Appellate

Tribunal. Does making the pre-deposit have any impact on recovery proceedings? [Study Mat]

Answer :

Legal Provision:-

Ü As per section 107(6) of CGST Act, no appeal shall be filed before the Appellate Authority (AA), unless

the appellant has paid:-

a) full amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by

him and

b) 10% of remaining amount of tax in dispute arising from the said order in relation to which appeal has

been filed, subject to maximum ₹ 25 Crores.

Ü Further, no appeal shall be filed to AA against an order u/s 129(3), unless a sum equal to 25% of the

penalty has been paid by the appellant.

Ü As per section 112(8) of CGST Act, no appeal shall be filed before the Appellate Tribunal (AT), unless

the appellant has paid:-

a) full amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by

him and

b) 20% of the remaining amount of tax in dispute, in addition to amount deposited before the Appellate

Authority, arising from the said order in relation to which appeal has been filed, subject to a

maximum of ₹ 50 Crore.

Ü The above limits are applicable for the pre-deposits to be made under the CGST Act. Accordingly, an equal

amount of pre-deposit is payable under the respective SGST/ UTGST Act also.

Ü If the appellant has paid the required pre-deposit, then the recovery proceedings for the balance

amount shall be deemed to be stayed till the disposal of the appeal.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 467