Page 9 - Chap22 Appeals & Revision

P. 9

- in consequence of an observation by Comptroller and Auditor General of India, then he may stay the

operation of such order for such period as he deems fit.

3) After giving an opportunity of being heard to the person concerned and making necessary further

inquiry, the RA may pass such order, as he thinks just and proper, including enhancing or

modifying or annulling the said decision/order.

4) Subject to further appeal to the Tribunal, High court or Supreme court, every revision order shall be

being final and binding on the parties.

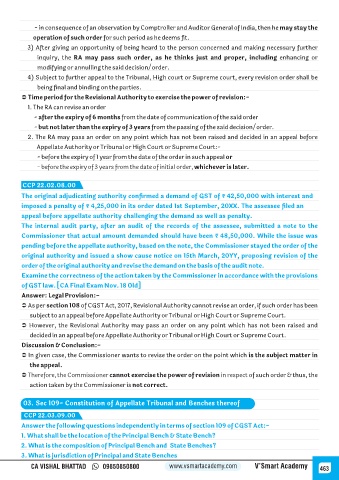

Ü Time period for the Revisional Authority to exercise the power of revision:-

1. The RA can revise an order

- after the expiry of 6 months from the date of communication of the said order

- but not later than the expiry of 3 years from the passing of the said decision/order.

2. The RA may pass an order on any point which has not been raised and decided in an appeal before

Appellate Authority or Tribunal or High Court or Supreme Court:-

- before the expiry of 1 year from the date of the order in such appeal or

- before the expiry of 3 years from the date of initial order, whichever is later.

CCP 22.02.08.00

The original adjudicating authority confirmed a demand of GST of ₹ 42,50,000 with interest and

imposed a penalty of ₹ 4,25,000 in its order dated 1st September, 20XX. The assessee filed an

appeal before appellate authority challenging the demand as well as penalty.

The internal audit party, after an audit of the records of the assessee, submitted a note to the

Commissioner that actual amount demanded should have been ₹ 48,50,000. While the issue was

pending before the appellate authority, based on the note, the Commissioner stayed the order of the

original authority and issued a show cause notice on 15th March, 20YY, proposing revision of the

order of the original authority and revise the demand on the basis of the audit note.

Examine the correctness of the action taken by the Commissioner in accordance with the provisions

of GST law. [CA Final Exam Nov. 18 Old]

Answer: Legal Provision:-

Ü As per section 108 of CGST Act, 2017, Revisional Authority cannot revise an order, if such order has been

subject to an appeal before Appellate Authority or Tribunal or High Court or Supreme Court.

Ü However, the Revisional Authority may pass an order on any point which has not been raised and

decided in an appeal before Appellate Authority or Tribunal or High Court or Supreme Court.

Discussion & Conclusion:-

Ü In given case, the Commissioner wants to revise the order on the point which is the subject matter in

the appeal.

Ü Therefore, the Commissioner cannot exercise the power of revision in respect of such order & thus, the

action taken by the Commissioner is not correct.

03. Sec 109- Constitution of Appellate Tribunal and Benches thereof

CCP 22.03.09.00

Answer the following questions independently in terms of section 109 of CGST Act:-

1. What shall be the location of the Principal Bench & State Bench?

2. What is the composition of Principal Bench and State Benches?

3. What is jurisdiction of Principal and State Benches

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 463