Page 14 - Chap22 Appeals & Revision

P. 14

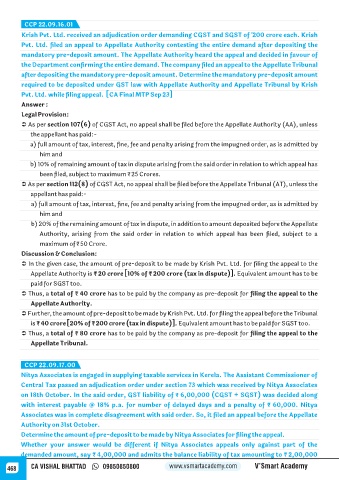

CCP 22.09.16.01

Krish Pvt. Ltd. received an adjudication order demanding CGST and SGST of ` 200 crore each. Krish

Pvt. Ltd. filed an appeal to Appellate Authority contesting the entire demand after depositing the

mandatory pre-deposit amount. The Appellate Authority heard the appeal and decided in favour of

the Department confirming the entire demand. The company filed an appeal to the Appellate Tribunal

after depositing the mandatory pre-deposit amount. Determine the mandatory pre-deposit amount

required to be deposited under GST law with Appellate Authority and Appellate Tribunal by Krish

Pvt. Ltd. while filing appeal. [CA Final MTP Sep 23]

Answer :

Legal Provision:

Ü As per section 107(6) of CGST Act, no appeal shall be filed before the Appellate Authority (AA), unless

the appellant has paid:-

a) full amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by

him and

b) 10% of remaining amount of tax in dispute arising from the said order in relation to which appeal has

been filed, subject to maximum ₹ 25 Crores.

Ü As per section 112(8) of CGST Act, no appeal shall be filed before the Appellate Tribunal (AT), unless the

appellant has paid:-

a) full amount of tax, interest, fine, fee and penalty arising from the impugned order, as is admitted by

him and

b) 20% of the remaining amount of tax in dispute, in addition to amount deposited before the Appellate

Authority, arising from the said order in relation to which appeal has been filed, subject to a

maximum of ₹ 50 Crore.

Discussion & Conclusion:

Ü In the given case, the amount of pre-deposit to be made by Krish Pvt. Ltd. for filing the appeal to the

Appellate Authority is ₹ 20 crore [10% of ₹ 200 crore (tax in dispute)]. Equivalent amount has to be

paid for SGST too.

Ü Thus, a total of ₹ 40 crore has to be paid by the company as pre-deposit for filing the appeal to the

Appellate Authority.

Ü Further, the amount of pre-deposit to be made by Krish Pvt. Ltd. for filing the appeal before the Tribunal

is ₹ 40 crore [20% of ₹ 200 crore (tax in dispute)]. Equivalent amount has to be paid for SGST too.

Ü Thus, a total of ₹ 80 crore has to be paid by the company as pre-deposit for filing the appeal to the

Appellate Tribunal.

CCP 22.09.17.00

Nitya Associates is engaged in supplying taxable services in Kerela. The Assistant Commissioner of

Central Tax passed an adjudication order under section 73 which was received by Nitya Associates

on 18th October. In the said order, GST liability of ₹ 6,00,000 (CGST + SGST) was decided along

with interest payable @ 18% p.a. for number of delayed days and a penalty of ₹ 60,000. Nitya

Associates was in complete disagreement with said order. So, it filed an appeal before the Appellate

Authority on 31st October.

Determine the amount of pre-deposit to be made by Nitya Associates for filing the appeal.

Whether your answer would be different if Nitya Associates appeals only against part of the

demanded amount, say ₹ 4,00,000 and admits the balance liability of tax amounting to ₹ 2,00,000

468 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy