Page 11 - Chap22 Appeals & Revision

P. 11

g) Setting aside any order of dismissal of any representation for default or any order passed by it ex-

parte and

h) Any other prescribed matter.

3) Enforcement just as decree of Court:-

Ü Any order made by the Appellate Tribunal may be enforced by it in the same manner as if it were a

decree made by a court in a suit pending therein.

Ü The Appellate Tribunal can send for execution of its orders to the court within the local limits of

whose jurisdiction,-

a) In case of an order against company, the registered office of the company is situated; or

b) In case of an order against any other person, the person concerned voluntarily resides or carries

on business or personally works for gain.

4) Proceedings are judicial proceedings:-

Ü All proceedings before Appellate Tribunal shall be deemed to be judicial proceedings within the

meaning of sections 193 & 228, and for section 196 of the Indian Penal Code.

Ü Appellate Tribunal shall be deemed to be civil court for the purposes of section 195 and Chapter XXVI

of the Code of Criminal Procedure, 1973.

05. Sec 112- Appeals to Appellate Tribunal

CCP 22.05.12.00

The Appellate Tribunal has the discretion to refuse to admit any appeal. Examine the correctness of

the above statement. [Study Mat]

Answer :

Ü The statement is partially incorrect.

Ü As per section 112 of CGST Act, though the Appellate Tribunal does have the power to refuse to admit an

appeal, it cannot refuse to admit any appeal. It can refuse to admit an appeal where –

a. the tax or input tax credit involved or

b. the difference in tax or the difference in input tax credit involved or

c. the amount of fine, fees or penalty determined by such order,

does not exceed ₹ 50,000.

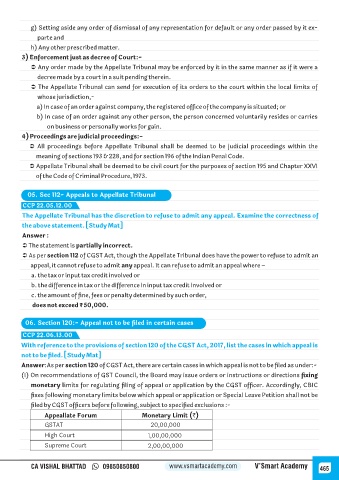

06. Section 120:- Appeal not to be filed in certain cases

CCP 22.06.13.00

With reference to the provisions of section 120 of the CGST Act, 2017, list the cases in which appeal is

not to be filed. [Study Mat]

Answer:As per section 120 of CGST Act, there are certain cases in which appeal is not to be filed as under:-

(I) On recommendations of GST Council, the Board may issue orders or instructions or directions fixing

monetary limits for regulating filing of appeal or application by the CGST officer. Accordingly, CBIC

fixes following monetary limits below which appeal or application or Special Leave Petition shall not be

filed by CGST officers before following, subject to specified exclusions :-

Appeallate Forum Monetary Limit (`)

GSTAT 20,00,000

High Court 1,00,00,000

Supreme Court 2,00,00,000

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 465