Page 4 - Chap22 Appeals & Revision

P. 4

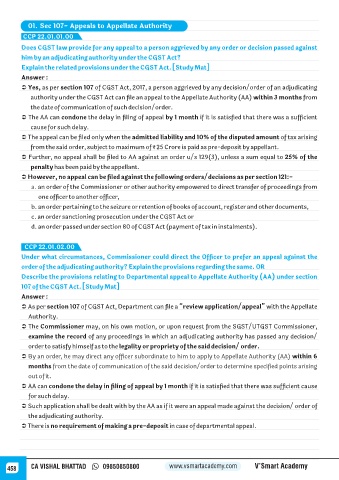

01. Sec 107- Appeals to Appellate Authority

CCP 22.01.01.00

Does CGST law provide for any appeal to a person aggrieved by any order or decision passed against

him by an adjudicating authority under the CGST Act?

Explain the related provisions under the CGST Act. [Study Mat]

Answer :

Ü Yes, as per section 107 of CGST Act, 2017, a person aggrieved by any decision/order of an adjudicating

authority under the CGST Act can file an appeal to the Appellate Authority (AA) within 3 months from

the date of communication of such decision/order.

Ü The AA can condone the delay in filing of appeal by 1 month if it is satisfied that there was a sufficient

cause for such delay.

Ü The appeal can be filed only when the admitted liability and 10% of the disputed amount of tax arising

from the said order, subject to maximum of ₹ 25 Crore is paid as pre-deposit by appellant.

Ü Further, no appeal shall be filed to AA against an order u/s 129(3), unless a sum equal to 25% of the

penalty has been paid by the appellant.

Ü However, no appeal can be filed against the following orders/decisions as per section 121:-

a. an order of the Commissioner or other authority empowered to direct transfer of proceedings from

one officer to another officer,

b. an order pertaining to the seizure or retention of books of account, register and other documents,

c. an order sanctioning prosecution under the CGST Act or

d. an order passed under section 80 of CGST Act (payment of tax in instalments).

CCP 22.01.02.00

Under what circumstances, Commissioner could direct the Officer to prefer an appeal against the

order of the adjudicating authority? Explain the provisions regarding the same. OR

Describe the provisions relating to Departmental appeal to Appellate Authority (AA) under section

107 of the CGST Act. [Study Mat]

Answer :

Ü As per section 107 of CGST Act, Department can file a “review application/appeal” with the Appellate

Authority.

Ü The Commissioner may, on his own motion, or upon request from the SGST/UTGST Commissioner,

examine the record of any proceedings in which an adjudicating authority has passed any decision/

order to satisfy himself as to the legality or propriety of the said decision/ order.

Ü By an order, he may direct any officer subordinate to him to apply to Appellate Authority (AA) within 6

months from the date of communication of the said decision/order to determine specified points arising

out of it.

Ü AA can condone the delay in filing of appeal by 1 month if it is satisfied that there was sufficient cause

for such delay.

Ü Such application shall be dealt with by the AA as if it were an appeal made against the decision/ order of

the adjudicating authority.

Ü There is no requirement of making a pre-deposit in case of departmental appeal.

458 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy