Page 7 - Chap22 Appeals & Revision

P. 7

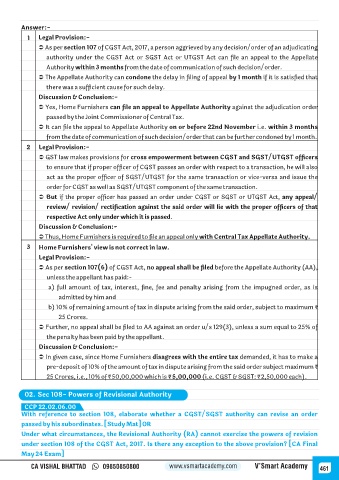

Answer:-

1 Legal Provision:-

Ü As per section 107 of CGST Act, 2017, a person aggrieved by any decision/order of an adjudicating

authority under the CGST Act or SGST Act or UTGST Act can file an appeal to the Appellate

Authority within 3 months from the date of communication of such decision/order.

Ü The Appellate Authority can condone the delay in filing of appeal by 1 month if it is satisfied that

there was a sufficient cause for such delay.

Discussion & Conclusion:-

Ü Yes, Home Furnishers can file an appeal to Appellate Authority against the adjudication order

passed by the Joint Commissioner of Central Tax.

Ü It can file the appeal to Appellate Authority on or before 22nd November i.e. within 3 months

from the date of communication of such decision/order that can be further condoned by 1 month.

2 Legal Provision:-

Ü GST law makes provisions for cross empowerment between CGST and SGST/UTGST officers

to ensure that if proper officer of CGST passes an order with respect to a transaction, he will also

act as the proper officer of SGST/UTGST for the same transaction or vice-versa and issue the

order for CGST as well as SGST/UTGST component of the same transaction.

Ü But if the proper officer has passed an order under CGST or SGST or UTGST Act, any appeal/

review/ revision/ rectification against the said order will lie with the proper officers of that

respective Act only under which it is passed.

Discussion & Conclusion:-

Ü Thus, Home Furnishers is required to file an appeal only with Central Tax Appellate Authority.

3 Home Furnishers' view is not correct in law.

Legal Provision:-

Ü As per section 107(6) of CGST Act, no appeal shall be filed before the Appellate Authority (AA),

unless the appellant has paid:-

a) full amount of tax, interest, fine, fee and penalty arising from the impugned order, as is

admitted by him and

b) 10% of remaining amount of tax in dispute arising from the said order, subject to maximum ₹

25 Crores.

Ü Further, no appeal shall be filed to AA against an order u/s 129(3), unless a sum equal to 25% of

the penalty has been paid by the appellant.

Discussion & Conclusion:-

Ü In given case, since Home Furnishers disagrees with the entire tax demanded, it has to make a

pre-deposit of 10% of the amount of tax in dispute arising from the said order subject maximum ₹

25 Crores, i.e., 10% of ₹ 50,00,000 which is ₹ 5,00,000 (i.e. CGST & SGST: ₹ 2,50,000 each).

02. Sec 108- Powers of Revisional Authority

CCP 22.02.06.00

With reference to section 108, elaborate whether a CGST/SGST authority can revise an order

passed by his subordinates. [Study Mat] OR

Under what circumstances, the Revisional Authority (RA) cannot exercise the powers of revision

under section 108 of the CGST Act, 2017. Is there any exception to the above provision? [CA Final

May 24 Exam]

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 461