Page 5 - Chap22 Appeals & Revision

P. 5

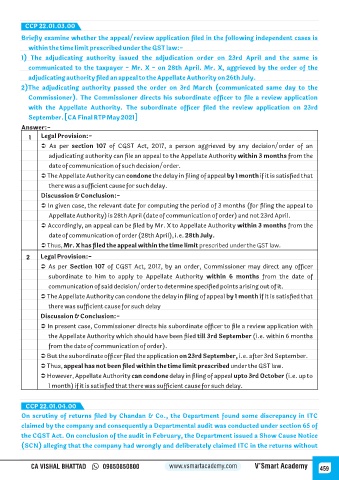

CCP 22.01.03.00

Briefly examine whether the appeal/review application filed in the following independent cases is

within the time limit prescribed under the GST law:-

1) The adjudicating authority issued the adjudication order on 23rd April and the same is

communicated to the taxpayer - Mr. X - on 28th April. Mr. X, aggrieved by the order of the

adjudicating authority filed an appeal to the Appellate Authority on 26th July.

2)The adjudicating authority passed the order on 3rd March (communicated same day to the

Commissioner). The Commissioner directs his subordinate officer to file a review application

with the Appellate Authority. The subordinate officer filed the review application on 23rd

September. [CA Final RTP May 2021]

Answer:-

1 Legal Provision:-

Ü As per section 107 of CGST Act, 2017, a person aggrieved by any decision/order of an

adjudicating authority can file an appeal to the Appellate Authority within 3 months from the

date of communication of such decision/order.

Ü The Appellate Authority can condone the delay in filing of appeal by 1 month if it is satisfied that

there was a sufficient cause for such delay.

Discussion & Conclusion:-

Ü In given case, the relevant date for computing the period of 3 months (for filing the appeal to

Appellate Authority) is 28th April (date of communication of order) and not 23rd April.

Ü Accordingly, an appeal can be filed by Mr. X to Appellate Authority within 3 months from the

date of communication of order (28th April), i.e. 28th July.

Ü Thus, Mr. X has filed the appeal within the time limit prescribed under the GST law.

2 Legal Provision:-

Ü As per Section 107 of CGST Act, 2017, by an order, Commissioner may direct any officer

subordinate to him to apply to Appellate Authority within 6 months from the date of

communication of said decision/order to determine specified points arising out of it.

Ü The Appellate Authority can condone the delay in filing of appeal by 1 month if it is satisfied that

there was sufficient cause for such delay

Discussion & Conclusion:-

Ü In present case, Commissioner directs his subordinate officer to file a review application with

the Appellate Authority which should have been filed till 3rd September (i.e. within 6 months

from the date of communication of order).

Ü But the subordinate officer filed the application on 23rd September, i.e. after 3rd September.

Ü Thus, appeal has not been filed within the time limit prescribed under the GST law.

Ü However, Appellate Authority can condone delay in filing of appeal upto 3rd October (i.e. up to

1 month) if it is satisfied that there was sufficient cause for such delay.

CCP 22.01.04.00

On scrutiny of returns filed by Chandan & Co., the Department found some discrepancy in ITC

claimed by the company and consequently a Departmental audit was conducted under section 65 of

the CGST Act. On conclusion of the audit in February, the Department issued a Show Cause Notice

(SCN) alleging that the company had wrongly and deliberately claimed ITC in the returns without

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 459