Page 10 - Chap24Computation of GST

P. 10

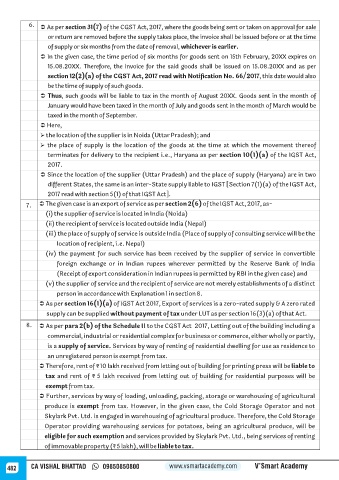

6.

Ü As per section 31(7) of the CGST Act, 2017, where the goods being sent or taken on approval for sale

or return are removed before the supply takes place, the invoice shall be issued before or at the time

of supply or six months from the date of removal, whichever is earlier.

Ü In the given case, the time period of six months for goods sent on 15th February, 20XX expires on

15.08.20XX. Therefore, the invoice for the said goods shall be issued on 15.08.20XX and as per

section 12(2)(a) of the CGST Act, 2017 read with Notification No. 66/2017, this date would also

be the time of supply of such goods.

Ü Thus, such goods will be liable to tax in the month of August 20XX. Goods sent in the month of

January would have been taxed in the month of July and goods sent in the month of March would be

taxed in the month of September.

Ü Here,

Ø the location of the supplier is in Noida (Uttar Pradesh); and

Ø the place of supply is the location of the goods at the time at which the movement thereof

terminates for delivery to the recipient i.e., Haryana as per section 10(1)(a) of the IGST Act,

2017.

Ü Since the location of the supplier (Uttar Pradesh) and the place of supply (Haryana) are in two

different States, the same is an inter-State supply liable to IGST [Section 7(1)(a) of the IGST Act,

2017 read with section 5(1) of that IGST Act].

7. Ü The given case is an export of service as per section 2(6) of the IGST Act, 2017, as-

(i) the supplier of service is located in India (Noida)

(ii) the recipient of service is located outside India (Nepal)

(iii) the place of supply of service is outside India (Place of supply of consulting service will be the

location of recipient, i.e. Nepal)

(iv) the payment for such service has been received by the supplier of service in convertible

foreign exchange or in Indian rupees wherever permitted by the Reserve Bank of India

(Receipt of export consideration in Indian rupees is permitted by RBI in the given case) and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct

person in accordance with Explanation 1 in section 8.

Ü As per section 16(1)(a) of IGST Act 2017, Export of services is a zero-rated supply & A zero rated

supply can be supplied without payment of tax under LUT as per section 16(3)(a) of that Act.

8. Ü As per para 2(b) of the Schedule II to the CGST Act 2017, Letting out of the building including a

commercial, industrial or residential complex for business or commerce, either wholly or partly,

is a supply of service. Services by way of renting of residential dwelling for use as residence to

an unregistered person is exempt from tax.

Ü Therefore, rent of ₹ 10 lakh received from letting out of building for printing press will be liable to

tax and rent of ₹ 5 lakh received from letting out of building for residential purposes will be

exempt from tax.

Ü Further, services by way of loading, unloading, packing, storage or warehousing of agricultural

produce is exempt from tax. However, in the given case, the Cold Storage Operator and not

Skylark Pvt. Ltd. is engaged in warehousing of agricultural produce. Therefore, the Cold Storage

Operator providing warehousing services for potatoes, being an agricultural produce, will be

eligible for such exemption and services provided by Skylark Pvt. Ltd., being services of renting

of immovable property (₹ 5 lakh), will be liable to tax.

482 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy