Page 8 - Chap24Computation of GST

P. 8

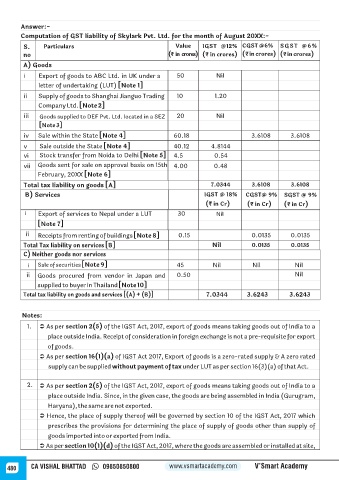

Answer:-

Computation of GST liability of Skylark Pvt. Ltd. for the month of August 20XX:-

S. Particulars Value IGST @12% CGST @6% SGST @6%

no (₹ in crores) (₹ in crores) (₹ in crores) (₹ in crores)

A) Goods

i Export of goods to ABC Ltd. in UK under a 50 Nil

letter of undertaking (LUT) [Note 1]

ii Supply of goods to Shanghai Jianguo Trading 10 1.20

Company Ltd. [Note 2]

iii Goods supplied to DEF Pvt. Ltd. located in a SEZ 20 Nil

[Note 3]

iv Sale within the State [Note 4] 60.18 3.6108 3.6108

v Sale outside the State [Note 4] 40.12 4.8144

vi Stock transfer from Noida to Delhi [Note 5] 4.5 0.54

vii Goods sent for sale on approval basis on 15th 4.00 0.48

February, 20XX [Note 6]

Total tax liability on goods [A] 7.0344 3.6108 3.6108

B) Services IGST @ 18% CGST@ 9% SGST @ 9%

(₹ in Cr) (₹ in Cr) (₹ in Cr)

i Export of services to Nepal under a LUT 30 Nil

[Note 7]

ii Receipts from renting of buildings [Note 8] 0.15 0.0135 0.0135

Total Tax liability on services [B] Nil 0.0135 0.0135

C) Neither goods nor services

i Sale of securities [Note 9] 45 Nil Nil Nil

ii Goods procured from vendor in Japan and 0.50 Nil

supplied to buyer in Thailand [Note 10]

Total tax liability on goods and services [(A) + (B)] 7.0344 3.6243 3.6243

Notes:

1. Ü As per section 2(5) of the IGST Act, 2017, export of goods means taking goods out of India to a

place outside India. Receipt of consideration in foreign exchange is not a pre-requisite for export

of goods.

Ü As per section 16(1)(a) of IGST Act 2017, Export of goods is a zero-rated supply & A zero rated

supply can be supplied without payment of tax under LUT as per section 16(3)(a) of that Act.

2. Ü As per section 2(5) of the IGST Act, 2017, export of goods means taking goods out of India to a

place outside India. Since, in the given case, the goods are being assembled in India (Gurugram,

Haryana), the same are not exported.

Ü Hence, the place of supply thereof will be governed by section 10 of the IGST Act, 2017 which

prescribes the provisions for determining the place of supply of goods other than supply of

goods imported into or exported from India.

Ü As per section 10(1)(d) of the IGST Act, 2017, where the goods are assembled or installed at site,

480 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy