Page 6 - Chap24Computation of GST

P. 6

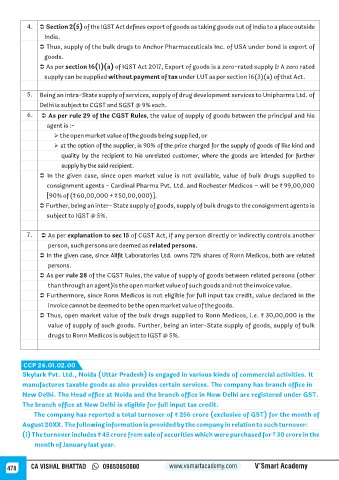

4. Ü Section 2(5) of the IGST Act defines export of goods as taking goods out of India to a place outside

India.

Ü Thus, supply of the bulk drugs to Anchor Pharmaceuticals Inc. of USA under bond is export of

goods.

Ü As per section 16(1)(a) of IGST Act 2017, Export of goods is a zero-rated supply & A zero rated

supply can be supplied without payment of tax under LUT as per section 16(3)(a) of that Act.

5. Being an intra-State supply of services, supply of drug development services to Unipharma Ltd. of

Delhi is subject to CGST and SGST @ 9% each.

6. Ü As per rule 29 of the CGST Rules, the value of supply of goods between the principal and his

agent is :-

Ø the open market value of the goods being supplied, or

Ø at the option of the supplier, is 90% of the price charged for the supply of goods of like kind and

quality by the recipient to his unrelated customer, where the goods are intended for further

supply by the said recipient.

Ü In the given case, since open market value is not available, value of bulk drugs supplied to

consignment agents - Cardinal Pharma Pvt. Ltd. and Rochester Medicos – will be ₹ 99,00,000

[90% of (₹ 60,00,000 + ₹ 50,00,000)].

Ü Further, being an inter- State supply of goods, supply of bulk drugs to the consignment agents is

subject to IGST @ 5%.

7. Ü As per explanation to sec 15 of CGST Act, if any person directly or indirectly controls another

person, such persons are deemed as related persons.

Ü In the given case, since Allfit Laboratories Ltd. owns 72% shares of Ronn Medicos, both are related

persons.

Ü As per rule 28 of the CGST Rules, the value of supply of goods between related persons (other

than through an agent)is the open market value of such goods and not the invoice value.

Ü Furthermore, since Ronn Medicos is not eligible for full input tax credit, value declared in the

invoice cannot be deemed to be the open market value of the goods.

Ü Thus, open market value of the bulk drugs supplied to Ronn Medicos, i.e. ₹ 30,00,000 is the

value of supply of such goods. Further, being an inter-State supply of goods, supply of bulk

drugs to Ronn Medicos is subject to IGST @ 5%.

CCP 24.01.02.00

Skylark Pvt. Ltd., Noida (Uttar Pradesh) is engaged in various kinds of commercial activities. It

manufactures taxable goods as also provides certain services. The company has branch office in

New Delhi. The Head office at Noida and the branch office in New Delhi are registered under GST.

The branch office at New Delhi is eligible for full input tax credit.

The company has reported a total turnover of 256 crore (exclusive of GST) for the month of ₹

August 20XX. The following information is provided by the company in relation to such turnover:

(i) The turnover includes 45 crore from sale of securities which were purchased for ` 30 crore in the ₹

month of January last year.

478 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy