Page 5 - Chap24Computation of GST

P. 5

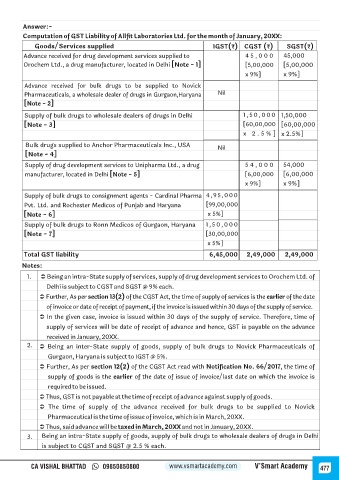

Answer:-

Computation of GST Liability of Allfit Laboratories Ltd. for the month of January, 20XX:

Goods/Services supplied IGST(₹) CGST (₹) SGST(₹)

Advance received for drug development services supplied to 4 5 , 0 0 0 45,000

Orochem Ltd., a drug manufacturer, located in Delhi [Note - 1] [5,00,000 [5,00,000

x 9%] x 9%]

Advance received for bulk drugs to be supplied to Novick

Pharmaceuticals, a wholesale dealer of drugs in Gurgaon,Haryana Nil

[Note - 2]

Supply of bulk drugs to wholesale dealers of drugs in Delhi 1 , 5 0 , 0 0 0 1,50,000

[Note - 3] [60,00,000 [60,00,000

x 2 . 5 % ] x 2.5%]

Bulk drugs supplied to Anchor Pharmaceuticals Inc., USA

Nil

[Note - 4]

Supply of drug development services to Unipharma Ltd., a drug 5 4 , 0 0 0 54,000

manufacturer, located in Delhi [Note - 5] [6,00,000 [6,00,000

x 9%] x 9%]

Supply of bulk drugs to consignment agents - Cardinal Pharma 4 , 9 5 , 0 0 0

Pvt. Ltd. and Rochester Medicos of Punjab and Haryana [99,00,000

[Note - 6] x 5%]

Supply of bulk drugs to Ronn Medicos of Gurgaon, Haryana 1 , 5 0 , 0 0 0

[Note - 7] [30,00,000

x 5%]

Total GST liability 6,45,000 2,49,000 2,49,000

Notes:

1. Ü Being an intra-State supply of services, supply of drug development services to Orochem Ltd. of

Delhi is subject to CGST and SGST @ 9% each.

Ü Further, As per section 13(2) of the CGST Act, the time of supply of services is the earlier of the date

of invoice or date of receipt of payment, if the invoice is issued within 30 days of the supply of service.

Ü In the given case, invoice is issued within 30 days of the supply of service. Therefore, time of

supply of services will be date of receipt of advance and hence, GST is payable on the advance

received in January, 20XX.

2. Ü Being an inter-State supply of goods, supply of bulk drugs to Novick Pharmaceuticals of

Gurgaon, Haryana is subject to IGST @ 5%.

Ü Further, As per section 12(2) of the CGST Act read with Notification No. 66/2017, the time of

supply of goods is the earlier of the date of issue of invoice/last date on which the invoice is

required to be issued.

Ü Thus, GST is not payable at the time of receipt of advance against supply of goods.

Ü The time of supply of the advance received for bulk drugs to be supplied to Novick

Pharmaceutical is the time of issue of invoice, which is in March, 20XX.

Ü Thus, said advance will be taxed in March, 20XX and not in January, 20XX.

3. Being an intra-State supply of goods, supply of bulk drugs to wholesale dealers of drugs in Delhi

is subject to CGST and SGST @ 2.5 % each.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 477