Page 4 - Chap24Computation of GST

P. 4

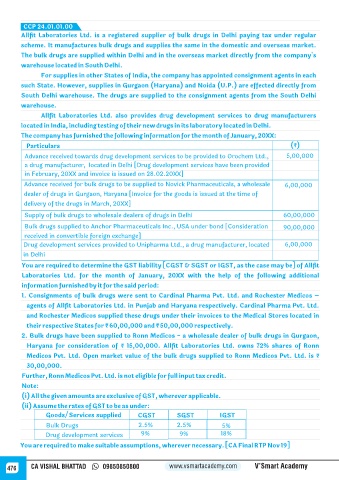

CCP 24.01.01.00

Question : 46

Allfit Laboratories Ltd. is a registered supplier of bulk drugs in Delhi paying tax under regular

scheme. It manufactures bulk drugs and supplies the same in the domestic and overseas market.

The bulk drugs are supplied within Delhi and in the overseas market directly from the company's

warehouse located in South Delhi.

For supplies in other States of India, the company has appointed consignment agents in each

such State. However, supplies in Gurgaon (Haryana) and Noida (U.P.) are effected directly from

South Delhi warehouse. The drugs are supplied to the consignment agents from the South Delhi

warehouse.

Allfit Laboratories Ltd. also provides drug development services to drug manufacturers

located in India, including testing of their new drugs in its laboratory located in Delhi.

The company has furnished the following information for the month of January, 20XX:

Particulars (₹)

Advance received towards drug development services to be provided to Orochem Ltd., 5,00,000

a drug manufacturer, located in Delhi [Drug development services have been provided

in February, 20XX and invoice is issued on 28.02.20XX]

Advance received for bulk drugs to be supplied to Novick Pharmaceuticals, a wholesale 6,00,000

dealer of drugs in Gurgaon, Haryana [Invoice for the goods is issued at the time of

delivery of the drugs in March, 20XX]

Supply of bulk drugs to wholesale dealers of drugs in Delhi 60,00,000

Bulk drugs supplied to Anchor Pharmaceuticals Inc., USA under bond [Consideration 90,00,000

received in convertible foreign exchange]

Drug development services provided to Unipharma Ltd., a drug manufacturer, located 6,00,000

in Delhi

You are required to determine the GST liability [CGST & SGST or IGST, as the case may be] of Allfit

Laboratories Ltd. for the month of January, 20XX with the help of the following additional

information furnished by it for the said period:

1. Consignments of bulk drugs were sent to Cardinal Pharma Pvt. Ltd. and Rochester Medicos –

agents of Allfit Laboratories Ltd. in Punjab and Haryana respectively. Cardinal Pharma Pvt. Ltd.

and Rochester Medicos supplied these drugs under their invoices to the Medical Stores located in

their respective States for ₹ 60,00,000 and ₹ 50,00,000 respectively.

2. Bulk drugs have been supplied to Ronn Medicos - a wholesale dealer of bulk drugs in Gurgaon,

Haryana for consideration of ₹ 15,00,000. Allfit Laboratories Ltd. owns 72% shares of Ronn

Medicos Pvt. Ltd. Open market value of the bulk drugs supplied to Ronn Medicos Pvt. Ltd. is ₹

30,00,000.

Further, Ronn Medicos Pvt. Ltd. is not eligible for full input tax credit.

Note:

(i) All the given amounts are exclusive of GST, wherever applicable.

(ii) Assume the rates of GST to be as under:

Goods/Services supplied CGST SGST IGST

Bulk Drugs 2.5% 2.5% 5%

Drug development services 9% 9% 18%

You are required to make suitable assumptions, wherever necessary. [CA Final RTP Nov 19]

476 CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy